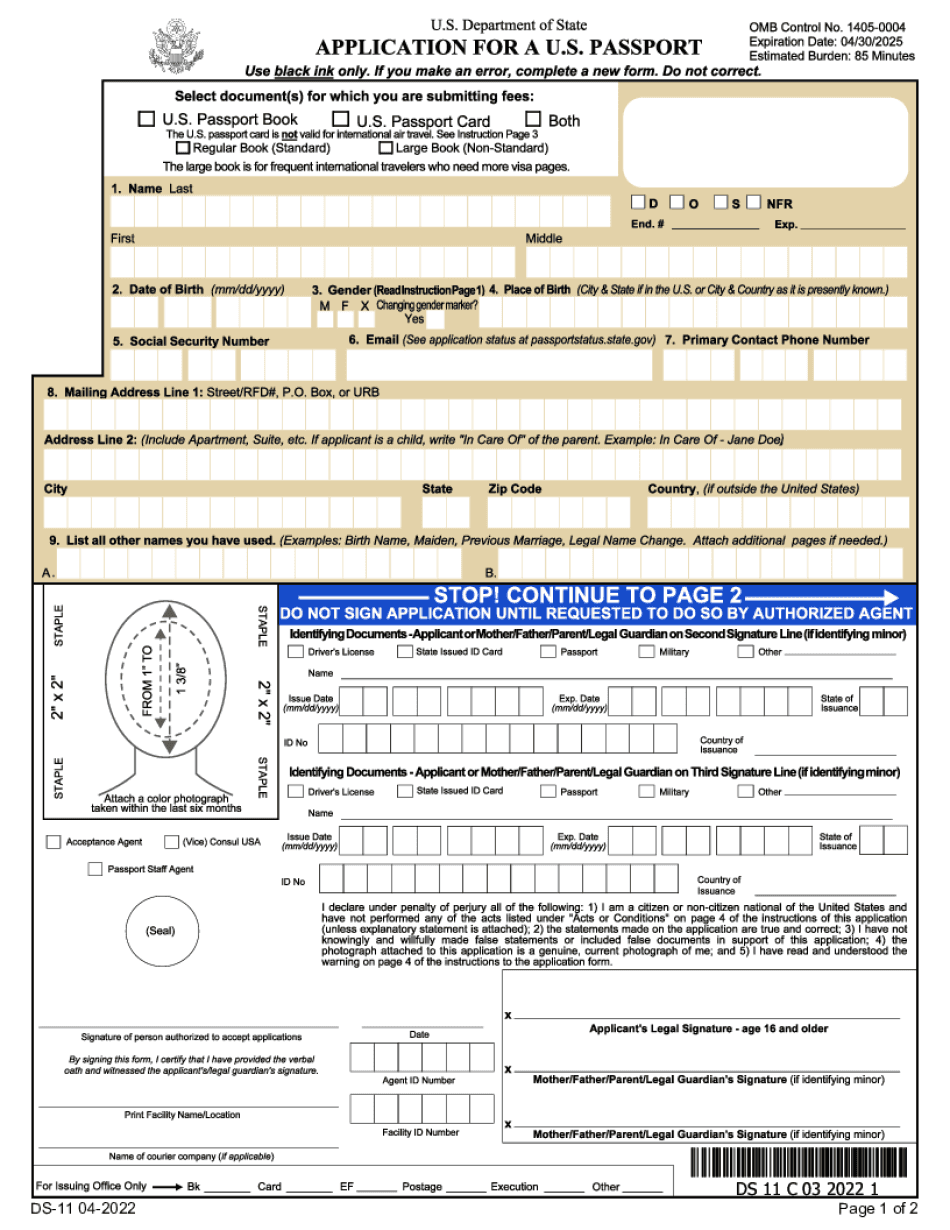

If you're applying for your U.S passport for the first time you don't want to miss this video hi everyone I'm Jackie and today I will go over how to apply for a U.S passport for the first time and provide tips to avoid some of the common mistakes all right if you're applying for a U.S passport for the first time you have to submit your application in person there are five main steps to apply for a U.S passport first filling out your ds-11 application you've recently attended your naturalization oath ceremony there's usually an application form included in your welcome package if not you can go to the official website travel.state.gov to get the latest version of the application form I'll add all of the links in the description you can either fill out the application online and print it out or printed out the PDF file and fill it out by hand let me show you quickly how you apply online go to travel.state.gov scroll down a little bit to I need a passport then click I'm an adult now click the plus symbol to the right of fill out form ds11 and choose form filler if you want to fill it out online or PDF if you want to print it out and fill it out by hand I find the form filler much easier to fill out and it shows you the fees so you know exactly how much you owe let's review the application briefly at the top you will need to choose if you want a passport book or a passport card or both the passport book is the traditional passport most people get for international air travel so if you plan on flying I recommend getting the book the passport card...

PDF editing your way

Complete or edit your ds 11 form printable anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export ds 11 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your ds 11 form printable 2021 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your ds 11 6 2016 fillable by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form DS-11

About Form DS-11

Form DS-11 is an application for a U.S. passport. It is the most commonly used form when applying for a new passport. This form is required for individuals who meet any of the following criteria: 1. First-time Applicants: People who have never held a U.S. passport or those who received it before turning 16 years old. 2. Minors: Children under the age of 16 who have never been issued a U.S. passport. 3. Expired or Lost Passports: Individuals whose previous U.S. passport is expired, lost, stolen, or damaged. 4. Expired Passports issued over 15 years ago: If your most recent passport was issued over 15 years ago, you will need to apply for a new passport using form DS-11. 5. Previous Passport Issued under the Age of 16: If your previous U.S. passport was issued when you were under 16 years old, you will need to reapply using form DS-11. It is important to note that when completing Form DS-11, applicants are required to submit proof of U.S. citizenship, identification documents, passport photos, and applicable fees. Additionally, all applicants using this form must appear in person at an authorized passport acceptance facility to verify their identity.

What Is Ds 11 Form?

Do you like to travel? Are you interested in starting your own business? Or probably you want to get a higher education? No passport - no way to make the above-mentioned issues real.

Form DS-11 is what you need in this case. It is the application that must be filed by all United States citizens if they want to obtain a first-time passport, replace the passport that was stolen, lost or damaged, renew the one that was expired for more than 5 calendar years ago or issued to the individuals younger than 15 years old.

An applicant must complete the Application Form for New U.S. Passport and prit to the regional agency or passport acceptance facility. You must attach all supporting documents that are required (e.g. the receipts or drafts from the bank that you have paid the fee, and proof of identity). Remember, that you file the unsigned form.

There is a set of the requirements that must be met by the applicants:

-

the U.S. passport has never been issued to you before;

-

you have approached the age of 16;

-

you were issued the most recent passport more than 15 years ago;

-

your most recent passport was stolen or lost;

-

you have changed the name since your first U.S. passport was issued and you did not document this change;

-

get ready to pra photo (2x2);

-

confirm your United States citizenship.

The photo that you attach must be taken on a white background and be in color. The face must be centered and normally visible. The photo taken more than 6 months ago is not acceptable. It is recommended to file the most recently updated version of Form DS-11 that is for 2013.

How to Fill out DS-11

You have an option to download the New Passport Application on our site. It may be available in both PDF and Word formats. We are sure you do not want to spend time, print the document and complete it over and over again because of the mistakes that can’t be left without editing. Fill out your DS-11 online, correct the mistakes instantly and send a perfectly completed sample to the regional agency.

Generally, the application consists of 2 pages. You must prthe following information while completing:

-

name (last, first and middle);

-

date and place of birth;

-

sex;

-

contact information;

-

social security number;

-

your previous names;

After you indicated all these details, you must input your photo that meets all requirements mentioned above. Apart from that, you must prthe information about your parents, wife or husband, your physical parameters like height, hair and eye color. If you have some travel plans, you must also describe them in a DS-11. Remember not to sign the document until it is required in the agency.

Online answers help you to organize your doc administration and enhance the efficiency of the workflow. Observe the fast guide in an effort to entire Form DS-11, keep clear of mistakes and furnish it inside of a timely way:

How to accomplish a Form DS-11 on line:

- On the website along with the type, click Start out Now and move towards editor.

- Use the clues to complete the applicable fields.

- Include your individual details and speak to details.

- Make absolutely sure that you enter correct info and quantities in suitable fields.

- Carefully look at the subject material belonging to the form likewise as grammar and spelling.

- Refer to assist area if you've got any questions or address our Aid team.

- Put an digital signature on your Form DS-11 when using the assistance of Indication Resource.

- Once the form is completed, push Accomplished.

- Distribute the ready type through e-mail or fax, print it out or conserve on your own product.

PDF editor permits you to make changes to your Form DS-11 from any world-wide-web connected system, customize it as outlined by your needs, indication it electronically and distribute in different methods.

What people say about us

It's a great idea to send forms online

Video instructions and help with filling out and completing Form DS-11